Q2 venture investing slows a tad, but the big money still flows into biotech

19 July 2016

Venture investing in biotech during the second quarter slowed somewhat from the blistering pace set in 2015, but the field still racked up another $1.7 billion, easily surpassing the mark for previous years and leaving 2016 on track to richly support the big new wave of drug developers in or near the clinic.

That’s the bottom line in the tally of venture rounds from the MoneyTree Report by PricewaterhouseCoopers and the National Venture Capital Association, based on data from Thomson Reuters.

That $1.7 billion marks a dip from Q1, when $1.8 billion was pumped into the biotech scene. And it’s down even further from the $2.1 billion counted in a record-setting Q2 for 2015, as the IPO boom helped fuel a rising tide of new investments. To give it some perspective, though, the $3.5 billion for the first half of this year still beats every other H1 on the books at the NVCA, except for 2015.

These numbers mark the flow of the life blood of the biotech field. Drug development is a pricey, extraordinarily risky endeavor marked by peril and promise at every step. Just ask Juno Therapeutics. These companies almost all operate in the red, until they either establish a commercial operation or get bought up, part of the food chain in which Big Pharma still commands the lion’s share of the portions.

Craig Venter

A cooler market on Wall Street for new biotech IPOs may be at least partly to blame for the loss of acceleration. But a slate of drug developers, including Kadmon, is still pushing their way in. And new funds appear regularly, with longtime players like Polaris rounding up a fresh cache of cash for a new round of portfolio investments.

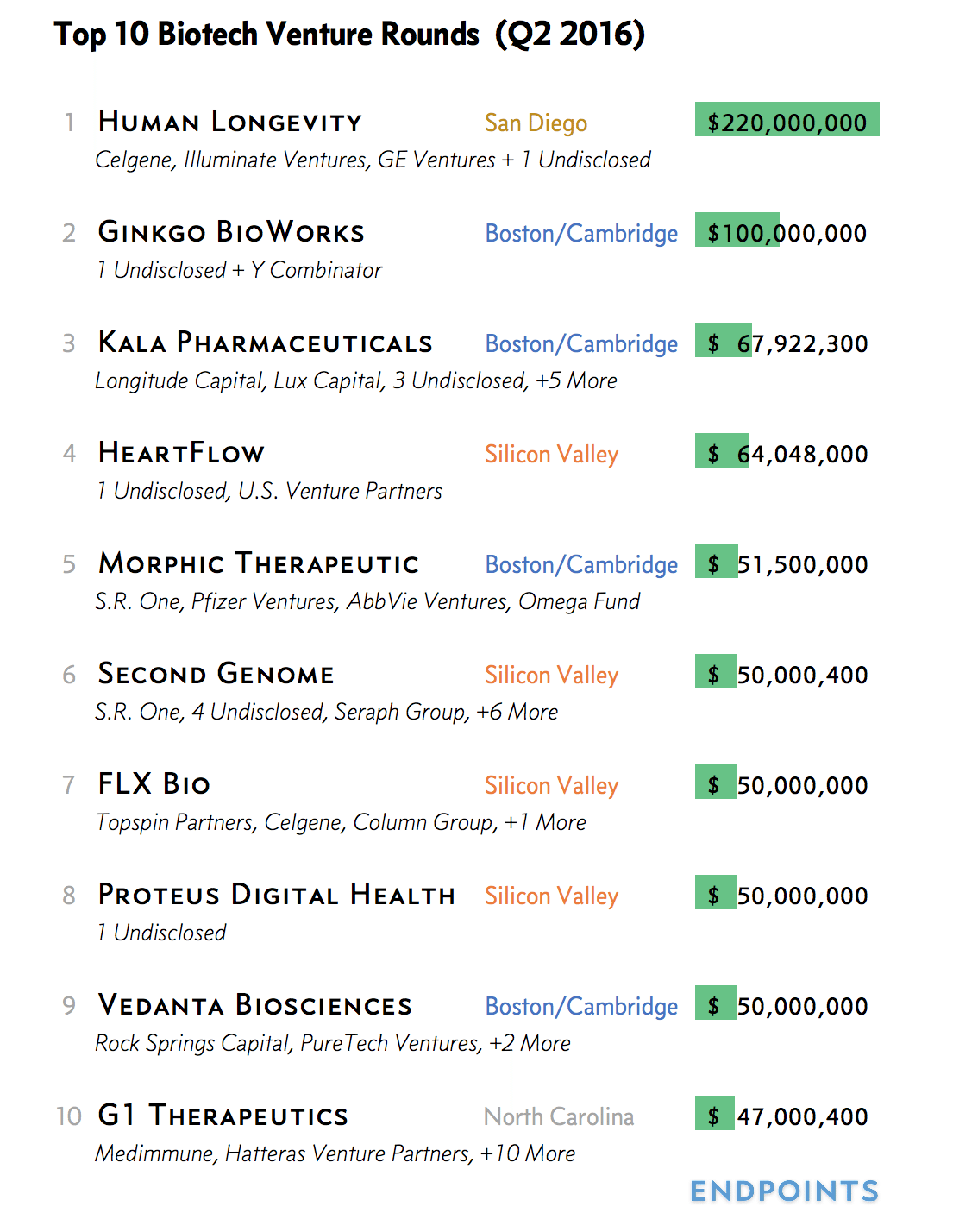

Helping out in Q2 were a couple of new megarounds, with Craig Venter’s Human Longevity scoring $220 million from a round led by Illumina, Celgene and GE Ventures.

We asked the NVCA to pull the top 10 biotech deals for the quarter. This is what they provided:

Our news

-

14 March 2024

-

26 February 2024

-

NovaMedica team wishes you a Merry Christmas and a Happy New Year!

26 December 2023