BD pharma execs make pitches; VC money sits as valuations climb

31 May 2016

SUZHOU, China – Snapping smartphone pictures of pharmaceutical company slides, entrepreneurs listened intently last week in a packed audience attending 15-minute presentations of business development executives looking for innovative products, not only in the Asia-Pacific region, but globally.

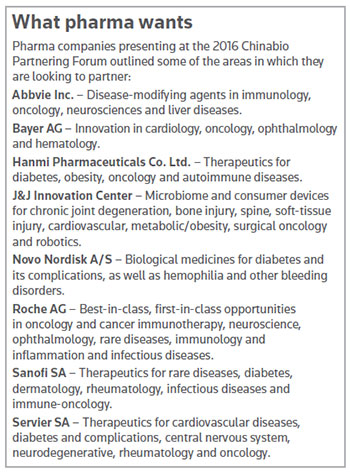

The presentations occurred on the second and final day of the Chinabio Partnering Forum in Suzhou’s Kempinski Hotel, and included top multinational companies, such as Johnson & Johnson, Novo Nordisk A/S, Roche AG and Sanofi SA, to name a few.

Next door, global biotech companies told their stories to potential partners. Down the hall, a panel of venture capitalists explained challenges with investments. Upstairs, executives met face-to-face, planting the seeds for potential licensing deals. During the entire forum, about 1,600 meetings occurred, indicating a committed, unwavering interest in accessing China’s market, as well as the drive to find the best innovative opportunities.

“Why bother? Why don’t we do it all in-house?” asked Tom Kinzel, head of Bayer AG’s innovation center in Beijing. “It gives us access. We believe it’s key to achieving breakthrough innovation in a number of fields,” in addition to offering flexibility, de-risking the company’s research and establishing networks in core areas.

“Why bother? Why don’t we do it all in-house?” asked Tom Kinzel, head of Bayer AG’s innovation center in Beijing. “It gives us access. We believe it’s key to achieving breakthrough innovation in a number of fields,” in addition to offering flexibility, de-risking the company’s research and establishing networks in core areas.

Bayer reported research and development expenditures in 2015 of €4 billion (US$3.55 billion) in 2015, with €2.5 billion (US$2.22 billion) focused on pharmaceuticals.

Roche’s Yingjie Wu said her company’s R&D investment was CHF9.3 billion (US$9.5 billion). Roche has 70 new molecular entities in clinical development, and four that received FDA breakthrough therapy designation last year. The company announced Thursday accelerated FDA approval of its anti-PD-L1 cancer immunotherapy, Tecentriq (atezolizumab), to treat a specific type of advanced bladder cancer. (See BioWorld Today, May 19, 2016.)

“In our research, about 50 percent of all new drugs originated either from academia or from the biotech industry, and we do believe we should get access to all these external innovations,” said Wu, associate director of Asia and emerging markets for Roche Partnering Shanghai.

About 35 percent of Roche’s pharma sales are generated from partnered products, she said, adding that Roche tailors its deal structures for companies with promising innovations.

“When you tell us about your story, please bring solid data,” she said. “We are a research-based company so we pay much attention to your science, and we hope it is well protected with IP or can be protected.”

Sarah Holland, head of external science and partnering from Paris-based Sanofi, said her company is agnostic when it comes to the modality, but it is willing to try anything to find solutions for rare diseases. “What we’re looking for is scientific excellence addressing unmet needs,” she said. “We have to convince payers nowadays. Health care budgets are under pressure.”

Four of the eight pharmaceutical companies that presented at the forum expressed interest in the area of diabetes. Anand Gautam, director of R&D innovation sourcing for Copenhagen-based Novo Nordisk, said 387 million people have diabetes in the world today, and the number is climbing, with 4.9 million people dying in 2014 due to the disease or its related complications.

“If you look at the current treatments, only 6 percent of the people of all these numbers really achieve the levels of glucose” needed to live a quality life, he said, calling diabetes “a colossal epidemic.”

Gautam said his company is proactive in engaging with academia, and realizes venture capitalists (VCs) tend to shy away from the diabetes area due to required postmarketing cardiovascular outcome trials with thousands of people.

“If there are any VCs in the room, please consider investing in good ideas for diabetes,” Gautam said.

HIGH VALUATIONS, DUMB MONEY

But VCs have their own problems dealing with high valuations, uninformed investors, misguided entrepreneurs and, in China, the competition of insurance firms that are now investing in innovators.

“They are only looking for 10 percent, and they are really long term,” said Karen Liu, a partner with 3E Bioventures, who was part of a morning panel focused on raising venture capital in China.

According to Chinabio, in 2015, there were more than $10 billion in new VC funds raised in China for life sciences and health care, with $6 billion raised so far this year.

“Essentially, there should be about $13 billion sitting around,” said Greg Scott, Chinabio Group’s founder and chairman, who moderated the panel. “The rate the money is going out is only a couple billion a year.”

Entrepreneurs are naively seeking alternative forms of investment, accepting what some panelists call “dumb money” from uninformed investors who are valuating companies too high, thereby making it difficult – if not impossible – for a company to conduct future rounds, and for anyone to make a profitable exit.

Jennifer Hu, a partner with Qiming Venture Partners US, suggested asking entrepreneurs to take care in selecting investors, so the company can “grow healthy, rather than feeding it too much, and then you are overweight.”

“You always have to leave room for the next round,” Liu agreed. “If you hike yourself up to $300-, $400-, $500-million dollar valuations, what’s your next step?”

Most of the investors say they are seeking early stage innovations, and that there are plenty of opportunities within China and abroad, but finding a balance between what VCs want and what entrepreneurs need is the challenge.

“There’s a valuation bubble right now,” said Tony Tong, vice president of Decheng Capital, “which is not just a challenge for me, it’s also a problem for the entrepreneur. It dilutes the entrepreneur.”

The panelists agreed that the world has become flat, with China innovation growing up and ready to co-develop with U.S. companies looking for a China perspective.

The VCs are ready to invest. Liu said assets must be competitive internationally, and VCs do not care where the innovation comes from.

“China and the U.S. are the two largest health care markets in the world,” she said. “Even smaller companies are actively thinking about their China strategy, whereas 10 years ago, they didn’t bother.”

PrintOur news

-

14 March 2024

-

26 February 2024

-

NovaMedica team wishes you a Merry Christmas and a Happy New Year!

26 December 2023