Biotech sector roars back with strong October performance

06 November 2015

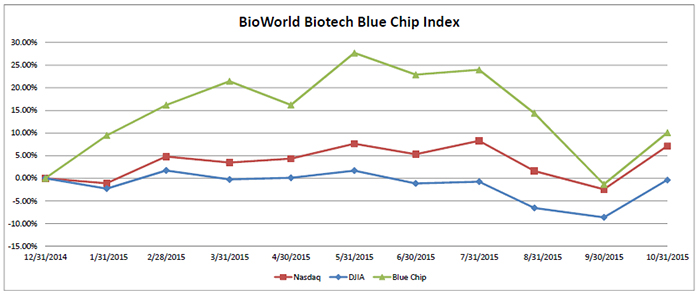

After suffering a 20 percent drop in value during August and September, the BioWorld Blue Chip Biotech Index, comprising 20 of the leading companies ranked by market cap, recovered over half of its losses with an 11.5 percent jump in October. Biotech benefited from a calmer, more positive period in the capital markets with the Nasdaq Composite index and the Dow Jones Industrial Average also recording strong growth of 10 percent and 9 percent, respectively. (See BioWorld Blue Chip Biotech Index, below.)

Investors will be hoping that the third quarter earnings season, which has just started for biotech companies, will help keep that momentum going.

Certainly, the industry's top two companies by market have not disappointed, getting the sector off on the right foot. Gilead Sciences Inc. posted an estimate-beating 70 percent rise in third quarter net profit. For the third quarter ended Sept. 30, the Foster City, Calif.-based company recorded total revenues of $8.3 billion, compared to $6 billion for the comparable period in 2014. Net income was $4.6 billion, or $3.06 per diluted share, compared to $2.7 billion, or $1.67 per diluted share in 2014.

Antiviral product sales were $7.7 billion for the third quarter, compared to $5.5 billion for the third quarter of 2014, primarily due to sales of hepatitis C virus (HCV) drug Harvoni (ledipasvir 90 mg/sofosbuvir 400 mg), which was approved in the U.S. and Europe in the fourth quarter of last year, partially offset by a decrease in sales of Sovaldi (sofosbuvir 400 mg) due primarily to the uptake in Harvoni. In the U.S., HCV product revenue totaled $3.2 billion, with Harvoni representing more than $2.5 billion, partly driven by patients shifting to the new combination from Sovaldi.

Other sales, which include Letairis (ambrisentan), Ranexa (ranolazine) and Ambisome (amphotericin B liposome for injection), were $509 million for the third quarter, compared to $424 million for the third quarter of 2014.

At the end of September, Gilead had a whopping $25.1 billion in cash, cash equivalents and marketable securities on hand thanks to the issuance of $10 billion senior unsecured notes in September and generating $4.1 billion in operating cash flow.

The firm's bulging bank balance means the company is well placed to pull the trigger on an acquisition if the opportunity arises.

Cory Kasimov, analyst at J.P. Morgan noted that the company has indicated in the past it would be aggressive for the right asset and that "they are not closing the door on a more transformative deal." (SeeBioWorld Today, Oct. 29, 2015.)

Gilead's shares (Nasdaq:GILD) grew 11.2 percent in October and they are up almost 16 percent year to date.

Emulating Gilead's strong results, Thousand Oaks, Calif.-based Amgen Inc. recorded a 14 percent increase in total revenues for the third quarter. The $5.7 billion in sales growth were driven primarily by Enbrel (etanercept), Sensipar (cinacalcet), Neulasta (pegfilgrastim), Prolia (denosumab), Xgeva (denosumab) and Kyprolis (carfilzomib), the company said

The company generated $2.7 billion of free cash flow, compared to $2.6 billion in the third quarter of 2014, and closed the quarter with about $31 billion in cash and cash equivalents. Amgen's shares (Nasdaq:AMGN) jumped a healthy 16 percent in October.

Expect to see the sector keep investors fully engaged once again in the final two months of this year, with the BioWorld Blue Chip Biotech Index improving on its current year-to-date performance of 4 percent.

The next two quarters also could be exciting ones in terms of asset purchases by big pharma and big biotech.

New York-based Pfizer Inc., for example, has got the ball rolling on what could be a number of potential mega-deals, confirming what has long been rumored that it is in "friendly" talks with Allergan plc, of Dublin. (See BioWorld Today, Oct. 30, 2015.)

PrintOur news

-

14 March 2024

-

26 February 2024

-

NovaMedica team wishes you a Merry Christmas and a Happy New Year!

26 December 2023