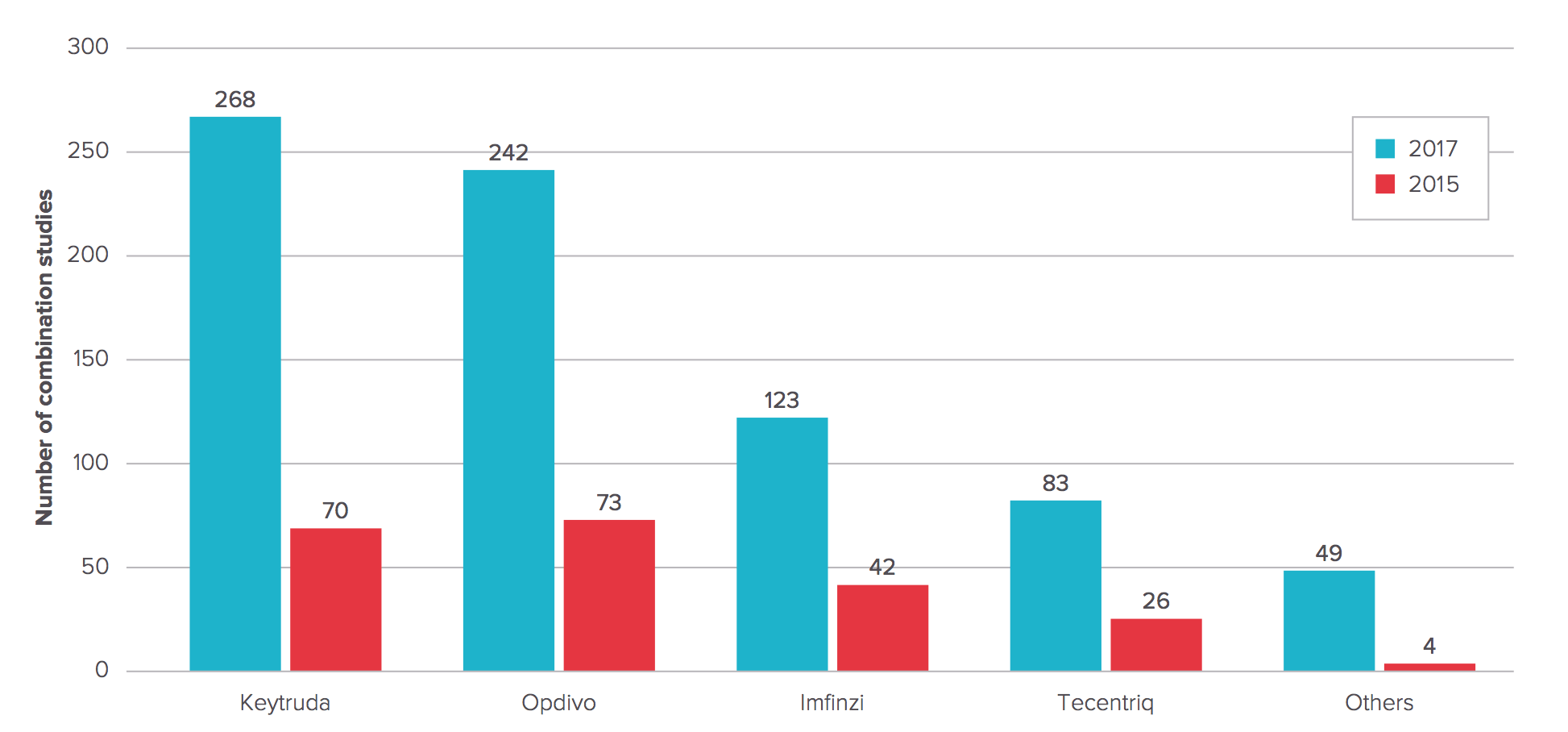

Number of Anti-PD-1/PD-L1 MAb combination studies 2015 vs. 2017

Full Report: Evaluate Ltd. May 2017

Over the last few months it hasn’t been unusual to see new combination studies being announced on a daily basis, matching one of the 5 approved PD-(L)1 checkpoint drugs with another cancer therapy. Some mornings they come in pairs.

It’s not hard to see why. The checkpoints typically work as a monotherapy — though there have been some nasty setbacks over the past 6 months. And some of the big players are happy to contribute their drug to studies sponsored by others looking to advance a pilot Phase I/II exploratory study. There are also recent examples of some big tie-ups between Merck (Keytruda) and Bristol-Myers Squibb (Opdivo) checkpoints with Incyte in Phase III.

Incyte has its own PD-1 in the clinic as it lines up these agnostic late-stage trials to position its leading IDO1 drug.

Now EP Vantage has tallied the whole score on these combo trials, not coincidentally just ahead of ASCO, and found a stunning 765 combination studies listed on clinicaltrials.gov. Keytruda leads the pack, with 268 — up from 70 just 18 months ago. For Bristol-Myers it’s 242, more than three times the number EP Vantage’s editorial team found in 2015.

Anyone even moderately interested in this field will want to check it out directly. There’s a lot of detail on what’s now in the clinic.

Don’t expect the rising trend lines to start to plateau anytime soon, either, as Pfizer/Merck KGaA (Bavencio) and AstraZeneca (Imfinzi) start to gain traction on the combo front. Roche already emerged as the number three player in the field with Tecentriq, though its recent Phase III failure for its checkpoint may chill other would-be partners.

Meanwhile, new checkpoint players like BeiGene and Lilly are moving along, the report notes, while Novartis has been advancing its own in-house checkpoint programs. The second wave of PD-(L)1 therapies will be large.

One of the key next steps in this field is in AstraZeneca’s hands. It has a combo of Imfinzi with an in-house CTLA-4 checkpoint dubbed tremelimumab in the MYSTIC study that will read out soon for lung cancer. Analysts are waiting eagerly to see if it can beat out the competition, or get sidelined by some well-known toxicity concerns.

One thing is absolutely certain. Bristol-Myers Squibb started as the dominant player in PD-(L)1, then got checked by a surging Merck when it made the wrong clinical move on non-small cell lung cancer. AstraZeneca, the last of the big 5 to land an approval, just days ago stunned virtually everyone with positive Phase III data for Imfinzi in unresectable lung cancer, providing early dominance in a significant niche market.

The Big Pharma’s stock soared as analysts began to calculate what that is worth.

Just at a time when checkpoints should start getting more predictable, the field seems to be ripe for fresh surprises of all kinds. And that will continue to attract fresh waves of combination studies tackling all kinds of cancers.