U.S. Venture Industry Continues to Normalize as Investors Return to a More Disciplined Approach

10 April 2017

* Venture investment activity sees $16.5 billion deployed to 1,797 companies in first quarter

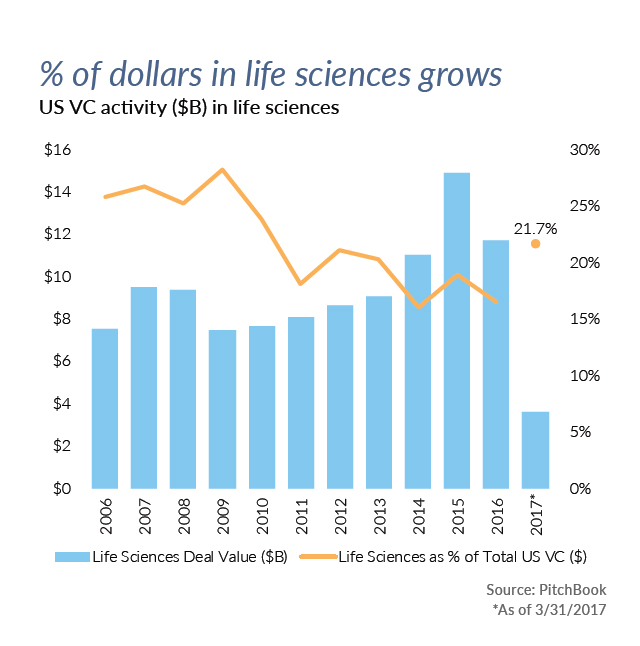

* % of dollars in Life Sciences grows to 21,7% of Total US VC

* Overall Life Sciences deal % nears seven-year high - 14,8%

|

|

SEATTLE, WA – During the first quarter of 2017, investors deployed $16.5 billion to 1,797 venture-backed startups, marking a slight uptick in capital invested over Q4 2016, but the fewest companies to receive investment since Q4 2011, according to the PitchBook-NVCA Venture Monitor. This decline, while significant compared to peak investment levels recorded between 2014 and 2016, indicates that the deceleration that started in the back half of 2016 continues in 2017 as the venture industry returns to a steadier pace of investment. Despite the slowdown in deal making, venture firms have plenty of cash to deploy to promising startups across the United States. Following a record year for venture fundraising in 2016, investors raised $7.9 billion across 58 vehicles, building on the record U.S. dry powder figures.

“After several consecutive years of elevated U.S. venture activity, it seems the industry is finally coming back down to earth,” said John Gabbert, Founder & CEO of PitchBook. “It’s easy to look at the numbers and assume the industry is starting to lose its footing, but we don’t think that’s the case. We see this as investors and entrepreneurs returning to a more disciplined approach to investing. Both parties are having to exercise more caution in the market and conduct the necessary due diligence to pencil out fair deals on both sides.”

“The deceleration of investment activity that we experienced at the end of 2016 continued in the first quarter, signifying that we are in fact returning to a more rational level of investment activity more in line with the annual growth rate of the industry over the last ten years,” said Bobby Franklin, President and CEO of NVCA. “After seeing large pools of capital raised in recent quarters, venture investors will continue to have dry powder to deploy to the entrepreneurial ecosystem, albeit with a more disciplined approach. Combined with a positive outlook for a strengthening IPO environment for venture-backed companies, there is much to be optimistic about in 2017.”

Fundraising activity

Limited partners continue to show interest in the venture asset class, as evidenced by the sustained level of fundraising, investors’ ability to continue hitting their fund targets and the number of first time funds coming to market in the first quarter. Venture capitalists raised $7.9 billion across 58 funds in the first quarter, down roughly 24% from the same period last year. Of the funds closed, 80% hit their target. At the same time, nine first-time funds closed during the first quarter, the most in the last five quarters.

A major contributing factor to the decline in fundraising totals in the first quarter was the absence of mega-funds raised. Most of the vehicles raised during Q1 2017 were sub-$250 million and just 11 of the 58 funds closed during the quarter were valued at or above $250 million. Of those 11 funds, just two—raised by Mithril Capital and Spark Capital—were worth more than $500 million. Such strong fundraising figures, especially in the absence of mega-funds, bodes well for VC fundraising for the rest of 2017.

Investment activity

In the first quarter of 2017, investors deployed $16.5 billion to 1,797 venture-backed startups, including investments into Airbnb, SoFi and Instacart, which raised a combined $1.9 billion. While this represents a decline from the high marks reached between 2014 and 2016, Q1 deal flow figures are more in line with the growth rate of annualized investment activity over the last 10 years. Given that, this slowdown in investment activity is less of a fundamental decline in investors’ interest in innovative startups, and more of a return to more rational investment levels.

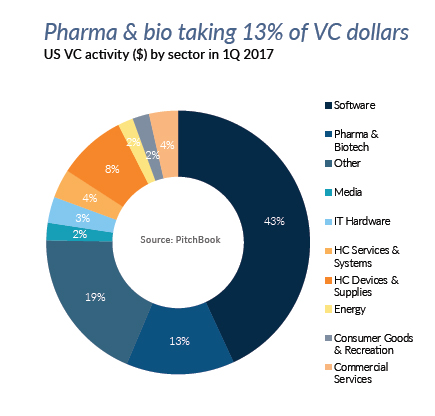

Angel and seed deals took the biggest hit in terms of the number of completed financings, with just 827 deals completed in the first quarter of 2017, down from 1,223 recorded in Q1 2016. In addition, the number of completed first financings fell to just 497 in the first quarter, the fewest in a single quarter in almost seven years. Investments into software and life sciences accounted for the majority of deal activity with more than 930 deals completed in Q1.

By geography, venture investors deployed capital to startups across 46 states and the District of Columbia, spanning 138 Metropolitan Statistical Areas (MSAs). In California, 560 companies received $8.3 billion in venture investment, representing 50% of total capital deployed and 31% of companies receiving investment for the quarter. Of all companies in the U.S. receiving investment, 69% were outside of California, drawing 50% of total capital invested.

Exit activity

Despite widespread optimism about the venture-backed exit environment at the end of 2016, the pace of exit activity continued to slow in Q1 2017. In the first quarter, 169 VC-backed companies exited, just seven of which debuted as initial public offerings on the U.S. exchanges. The lack of available late-stage funding coupled with the initial success of the Snap and Mulesoft IPOs could result in more venture-backed companies following suit. Plus, the median IPO exit size (while based on a small sample size) sits at $104 million, the highest figure in at least 12 years.

Corporate acquisitions and buyouts continued to be the most popular exit routes for venture-backed companies at the start of 2017, with 132 completed deals disclosed during Q1. Top venture-backed exits included the acquisition of AppDynamics and Bai, which both exited for north of $1 billion. The median exit size for disclosed acquisitions and buyout transactions was $40 million, down from the $86.3 million recorded last year. The most promising sectors for exits in Q1 2017 were software, biotech and commercial services, which accounted for 73% of total exits.

PrintOur news

-

14 March 2024

-

26 February 2024

-

NovaMedica team wishes you a Merry Christmas and a Happy New Year!

26 December 2023

Media Center

-

Research calls for greater investment in Alzheimer’s clinical trials

03 May 2024

-

Stress impact on protein particle formation for monoclonal antibody formulation

03 May 2024

-

Health Ministry registered Russian drug for ankylosing spondylitis

02 May 2024

-

Production of finished drugs in Russia grew by 13.8%

02 May 2024