Despite capital markets meltdown money flows into biopharma

01 February 2016

With the 34th annual J.P. Morgan Healthcare conference now in our rearview mirror we can reflect on the lessons learned from that pivotal event that traditionally helps set the agenda for the industry. There is no doubt that biopharma executives attending the meeting generally believe that 2016 will be vibrant – a sentiment echoed by many of the presenting companies who indicated they were looking forward to an "exciting" year ahead. Investors seem to be of the same mind, with more than $2 billion flowing to public and private companies so far in January despite the unfavorable capital markets.

The amount of cash raised compares favorably with the same period last year when the sector was still in bullish mode.

Executives were less certain that the sector's inherent strong fundamentals will help translate into a positive performance on the capital markets this year. If January is any indication, then biotech is in for a subpar year. The turbulence in the markets could be what investors will likely encounter throughout the year.

"We are certainly going to see market volatility this year as we head into election year," John Chambers, vice chairman, head of health care investment banking at Roth Capital Partners, told BioWorld Insight.

IT'S BRUTAL OUT THERE

Although you would think the price of oil would not have too much influence on the performance of the biopharmaceutical sector, it made no difference to investors as they exited the space big time as oil continued to sink lower. It wasn't all the fault of oil, of course; add to the mix geopolitical and macroeconomic uncertainties and stock roiling in China where the Chinese stock market has spent the first three weeks of the year in a virtual free fall, hitting a year-long bottom. (See BioWorld Today, Jan. 21, 2016.)

As a result, the BioWorld Blue Chip Biotech Index, which comprises 20 of the leading companies ranked by market cap, closed last Thursday down a whopping 19 percent in value since the beginning of the year. (See BioWorld Blue Chip Biotech Index, below.)

To make matters worse, biopharma companies served up a string of clinical trial disappointments, including Alkermes plc's lead candidate, the once-daily depression medicine ALKS 5461, which missed efficacy endpoints in two phase III trials, dragging company shares (NASDAQ:ALKS) down by 44.2 percent to $26.73 by Thursday's market close, as analysts deeply discounted the drug's chances of success, cutting millions of dollars of projected revenue from the company's future earnings. (See BioWorld Today, Jan 22, 2016.)

ALKS 5461 comprises a combination of samidorphan, an oral opioid modulator, and the opioid buprenorphine. The company is developing it for the treatment of major depressive disorder in patients who have an inadequate response to standard antidepressant therapies, an indication for which it gained FDA fast track status in October 2013.

Oncogenex Pharmaceuticals Inc., of Vancouver, British Columbia, reported that its combination of apatorsen with carboplatin and pemetrexed failed to demonstrate a statistically significant progression-free survival (PFS) benefit in untreated metastatic non-small-cell lung cancer during the placebo-controlled, double-blind, randomized phase II Spruce trial. The company said a potential PFS benefit was observed in patients with high baseline serum Hsp27 status when treated with apatorsen and that the study is ongoing. Overall survival results are expected in the second half of 2016.

Eleven Biotherapeutics Inc. also reported a phase III top-line failure in severe allergic conjunctivitis (pink eye) with interleukin-1 signaling inhibitor EBI-005 (isunakinra). No statistically significant differences turned up in the phase III conjunctivitis trial between the EBI-005-treated group and the vehicle control group on the primary endpoint of ocular itching or on any secondary endpoints, though the compound was generally well tolerated, with 94 percent of the patients staying on the experiment and no serious adverse events reported.

Certainly not a very auspicious start, which has also seen the Nasdaq Composite index and the Dow Jones Industrial Average tumble almost 11 percent and 9 percent, respectively.

Big pharma companies so far have managed to weather the brutal markets a little better, with the BioWorld Pharma Index falling approximately 8 percent since the beginning of the year. (See BioWorld Pharma Index, below.)

CAPITAL FLOWS

While the debate will rage on about when, and if, the markets will recover, there is no doubt that the record year in terms of raising capital the industry experienced last year has spilled over into 2016.

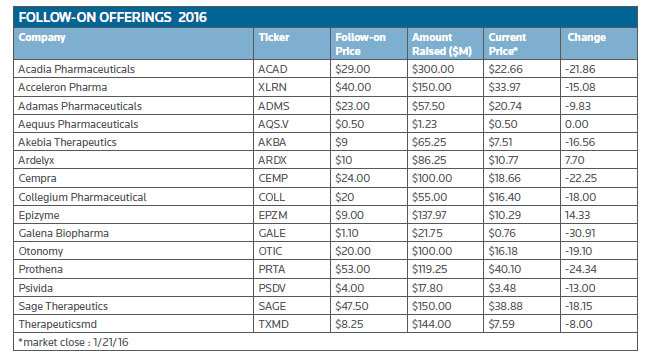

To start the year, no fewer than 15 companies completed follow-on offerings, collectively raising $1.5 billion. Not a bad haul in less than perfect markets.

"What you saw coming right of the gate this year was the number of follow-ons, which surprised people given the market turmoil," noted Chambers. "However, they were already prepared to go and past a point of no return despite the unfavorable conditions."

In addition, companies and their bankers probably concluded that it was better to complete a financing transaction early in the year rather than later because attention will switch to the presidential election race as midyear approaches, he added.

Topping the list of offerings was Acadia Pharmaceuticals Inc., which priced an underwritten public offering of 10.34 million shares of its common stock at $29 per share to gross approximately $300 million to boost its bank balance to well over $500 million. Its lead product is Nuplazid (pimavanserin) to treat psychosis associated with Parkinson's disease (PDP) for which the San Diego-based firm submitted its new drug application and has an upcoming PDUFA date of May 1. Nuplazid is a selective serotonin inverse agonist that targets 5-HT2A receptors. The FDA granted breakthrough therapy designation for the drug in PDP in 2014.

Therapeuticsmd Inc. closed an underwritten public offering of approximately 17.4 million shares of its common stock, which included the full exercise of underwriters' option to purchase up to an additional 15 percent of the shares at $8.25 each for gross proceeds of approximately $144 million. The company said it plans to use a majority of the proceeds to fund commercialization activities for TX-004HR, its applicator-free vaginal estradiol softgel drug candidate.

Reflecting the market conditions, only two of the 15 follow-on offerings have managed to eke out a gain on their stock offering price. (See Follow-on offerings in 2016, below.)

Epizyme Inc.'s shares (NASDAQ:EPZM) were up 14 percent from its $9 issue price early January at market close last Thursday. The company closed its public offering of 15.3 million shares, including 2 million shares issued upon the exercise in full by the underwriters of their option to purchase additional shares.

Epizyme Inc.'s shares (NASDAQ:EPZM) were up 14 percent from its $9 issue price early January at market close last Thursday. The company closed its public offering of 15.3 million shares, including 2 million shares issued upon the exercise in full by the underwriters of their option to purchase additional shares.

Epizyme is developing tazemetostat for the treatment of non-Hodgkin lymphoma patients and patients with INI1-deficient solid tumors. In many human cancers, aberrant EZH2 enzyme activity results in misregulation of genes that control cell proliferation resulting in the rapid and unconstrained growth of tumor cells.

Ardelyx Inc., of Fremont, Calif., generated $86.3 million from its public offering and its shares (NASDAQ:ARDX) closed up 7.7 percent from the offering price of $10. The company is focused on the discovery, development and commercialization of innovative, minimally systemic, small-molecule therapeutics that work exclusively in the gastrointestinal tract to treat gastrointestinal and cardiorenal diseases.

The disappointing after-market performances of the majority of companies completing follow-ons could keep others contemplating financings on the sidelines, particularly those looking at an IPO.

For example, this time last year – post J.P. Morgan meeting – five companies successfully completed IPOs before the end of January. This time around no offerings have so far been completed, although 10 have added themselves to the IPO runway, according to BioWorld Snapshots.

The question many analysts are currently wrestling with is, "Can the industry break free from the macroeconomic forces that are dragging on its valuation?"

An early indication for an answer will be provided in the coming weeks as the sector's blue chip biopharma companies report their year-end financials. RBC Capital Markets analyst Michael Yee in a research note said he thinks "Q4 results will be less robust and not as great as prior quarters - not a good thing. We expect a tougher year and things to warm in spring and into more catalysts into summer."

Overall, it is going to be a wild ride for the industry this year, and it will need to work hard to dig itself out of the hole it is in now to finish in positive territory before the end of the year.

NEW TRACKING INDICES

Since innovation in drug development has now spread well beyond the confines of traditional biotechnology companies, we are introducing a new BioWorld Biopharmaceutical Index that combines group members from the BioWorld Blue Chip Biotech Index and BioWorld Pharma Index. Its end-of month performance will be published in the Feb. 8 issue. The Blue Chip, Growth and Emerging Growth Biotech indices will be morphed into the BioWorld Drug Developers Index comprising representative companies from each of those three indices that have a market cap above $250 million and no drugs on the market. The BioWorld Pharma Index will be maintained.

PrintOur news

-

14 March 2024

-

26 February 2024

-

NovaMedica team wishes you a Merry Christmas and a Happy New Year!

26 December 2023