An Update on Clinical Development and Therapeutic Company Funding and Deals

07 July 2021

As the COVID-19 pandemic impacted the entire world, glimmers of hope that shined through the dark past year in large part came from the biotechnology sector. One of the most important developments in 2020 was the research and development which led to the use of three different COVID-19 vaccines in the United States thanks to Moderna and BioNTech’s groundbreaking mRNA vaccine technology and Johnson & Johnson’s one shot vaccine, and the eight authorized vaccines internationally.

Markets clearly took notice of these developments After launching Phase 2 trials for its vaccine last year, Moderna was able to raise more than $1.8 billion. As excitement surrounding new targeted therapies and vaccines grew, other companies outside of COVID R&D were also able to raise significant capital. Both the NASDAQ and S&P biotech stock market indices rose more than 50% from March lows as many success stories showed that the biotechnology sector not only preserved but also created jobs in a uniquely challenging time for the global economy. Ultimately, increased media coverage highlighting developments in the biotechnology sector demonstrated the importance of investing significantly in research and development.

At the second-annual BIO Digital International Convention, during a conference session titled “Emerging Therapeutic Company Investment, By the Numbers” David Thomas, BIO’s Vice President for Industry Research, showcased new analysis for funding and deal trends in 2020 and the first half of 2021. The presentation, noted historically as a State of the Industry for small biotechs, also included FDA approvals and clinical pipeline data that is now featured on BIO’s newest tracker webpage.

Emerging Company Data for 2020 versus 2021

In many respects, 2020 was an unprecedented year—and “a very strong year” in deal-making, according to BIO’s David Thomas. Against the backdrop of the COVID-19 pandemic, the financing landscape for Follow-On Offerings, IPOs, and M&A activity resulted in several instances of record number of transactions for record total dollar amounts. In terms of Follow-On Offerings for U.S. and non-U.S. firms as well as U.S. IPOs and venture capital investments in both U.S. and non-U.S. companies, there were also record deals for record dollar amounts. The same was true for acquisitions of R&D-stage companies and the out-licensing of R&D-stage assets.

Emerging Therapeutic Companies had a record year in the stock market

In 2020, the biotechnology market cap weighted index exceeded its previous peak of 2015. There was also large growth in R&D-stage biotech public offerings from the beginning of the pandemic up until today, meaning that there were more opportunities for investors to buy shares of stock in emerging therapeutic companies that were either in the process of developing new products.

Of the top 20 R&D-stage Follow-On Offerings in 2020, 10 were focused on oncology while the other 10 were not oncology related. As for 2021, year to date, there have been 75 Follow-On Offerings (with a minimum value of over $10 million) and a total of $7.5 billion has been raised so far.

In addition, there were 64 R&D-stage initial public offerings (IPOs) in the United States in 2020, which raised $10 billion. Outside the United States, there were 35 R&D-stage initial public offerings (IPOs) in 2020, which raised $6.7 billion. This number of IPOs and the amount of money raised in the past year far exceeds the 41 IPOs and $4.1 billion raised in the United States and the 11 IPOs and $1.2 billion raised abroad in 2019.

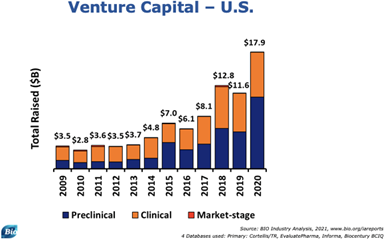

Venture Capital

A major driver of increased funding for life sciences and biotechnology firms was increased interest from venture capital firms. In the United States, $17.9 billion was raised in funding for therapeutic companies. This was a substantial increase compared to the $11.6 billion raised in 2019.

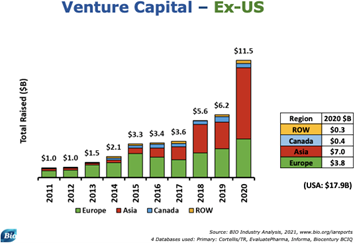

Beyond the United States, there were also major gains in venture capital backing of therapeutics firms. In 2020 alone, $11.5 billion was raised by venture capital firms for therapeutic companies, a marked increase compared to the $6.2 billion raised in 2019.

Out-Licensing of R&D-Stage Drug Assets

There has been remarkable progress in R&D-stage out-licensing deals from emerging therapeutic companies in recent years. By licensing the intellectual property of a product that is still in the R&D stage, small biotechs ensure strong partnerships to gain access to a target market and get a product to those who need it once it is fully developed. Back in 2012, there were only 98 deals (worth a minimum of $10 million) that totaled $26 billion in aggregate potential deal value. Just last year, on the other hand, there were 238 such deals worth $154 billion in aggregate potential deal value.

So far in 2021, data is showing a deal-making environment on par to slightly less than that seen in 2020. This may be attributed to there likely being fewer COVID-centric partnerships this year compared to last year, with the rest of the therapeutic area deals holding steady.

FDA Approvals and the Clinical Pipeline

|

2020 |

2021 (as of June 10th) |

|

49 |

25 |

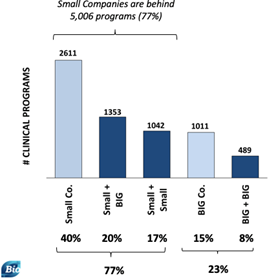

As for the clinical pipeline in 2021, smaller biotech firms are undoubtedly leading the way in these developments.

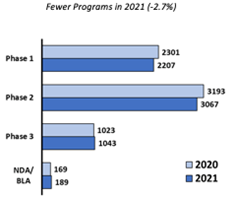

Small companies are behind 5,006 ongoing programs (out of 6,506 total), which represents 77% of clinical programs this year. Ultimately there have been fewer such programs in 2021, which are down 2.7% compared to 2020.

The COVID-19 pandemic has undoubtedly shifted R&D for many biotech firms as well as the investment priorities of dealmakers in the private sector. According to BIO’s analysis of the clinical pipeline in 2021, the top three non-oncology and oncology clinical NME/biologic programs (excluding biosimilars, reformulations, vaccines) are:

|

Non-Oncology Indicators & Programs |

Oncology Indicators & Programs |

|

COVID-19 152 ongoing programs |

Non-Small Cell Lung Cancer (NSCLC) 140 ongoing programs |

|

Alzheimer’s Disease 89 ongoing programs |

Acute Myelogenous Leukemia (AML) 128 ongoing programs |

|

Non-Alcoholic Steatohepatitis (NASH) 75 ongoing programs |

Breast Cancer 128 ongoing programs |

It is worth noting that oncology-related programs make up 43% of the pipeline. Additionally, in the non-oncology space, Moderna recently applied to the FDA for full U.S. approval of its COVID-19 vaccine, which would allow the firm to market the vaccine directly to consumers.

Since January 2020, changes at the FDA have been noteworthy—especially the Recombinant DNA Advisory Committee (RAC) reconfiguring its portfolio to handle both the ethical and safety issues surrounding the development of emerging biotechnologies and rebranding itself as the Novel and Exceptional Technology and Research Advisory Committee (NExTRAC). Ultimately, this along with recent guidances issued by the FDA on cell and gene therapy means that new drugs will be more efficiently and quickly approved thanks to the FDA’s expedited pathways.

Looking Ahead

With COVID likely to be far less an issue in the United States as it has been in 2020 and 1H 2021, emerging companies will likely continue to raise capital and close deals. Whatever the future holds, it is now clear that investment in the biotechnology sector will continue to be of the utmost importance in ensuring preparedness for future pandemics and to tackle other ongoing challenges such as in the oncology space.

PrintOur news

-

14 March 2024

-

26 February 2024

-

NovaMedica team wishes you a Merry Christmas and a Happy New Year!

26 December 2023

Media Center

-

Research calls for greater investment in Alzheimer’s clinical trials

03 May 2024

-

Stress impact on protein particle formation for monoclonal antibody formulation

03 May 2024

-

Health Ministry registered Russian drug for ankylosing spondylitis

02 May 2024

-

Production of finished drugs in Russia grew by 13.8%

02 May 2024