Biopharma sector needs to try harder to get a passing grade

09 September 2016

The summer is over and industry executives and investors alike will be getting back to work in earnest for the final four months push until the end of the year. Both groups will be hoping for a much better period going forward. By all metrics the sector has struggled to build any sustained momentum that provides any confidence that it will close its books on 2016 in positive territory. What can we expect – more of the same, or a sudden resurgence in fortunes for the sector?

Although biopharma performed well in July, collectively climbing 12 percent in value, raising expectations that the worst was over and better times lay ahead, hopes were dashed as the BioWorld Biopharmaceutical Index closed out August down almost 5 percent in August, pushing its year-to-date performance down to almost 14 percent. The Biopharmaceutical Index lags the general markets, with the Nasdaq Composite index up 1 percent in August and up 4 percent YTD. The Dow Jones Industrial average closed the month just below even but it is up 5.6 percent YTD. (See BioWorld Biopharmaceutical Index, below.)

Only Biogen Inc. and Merck & Co. Inc. were able to post positive figures in August. Biogen has had its fair share of news headlines – first, as a company that may be near the top of the M&A shopping list. Also, the company gave a name to the intended spinout of its hemophilia franchise. Bioverativ will be a stand-alone, publicly traded global biotechnology company that it expects to launch early next year. It will comprise commercial assets Alprolix (coagulation factor IX [recombinant], Fc fusion protein) and Eloctate (antihemophilic factor [recombinant], Fc fusion protein) and longer-acting factors, along with preclinical lentivirus-based hemophilia gene therapy assets partnered with Fondazione Telethon and Ospedale San Raffaele. Following completion of the transaction, Bioverativ plans to trade under the symbol BIVV on Nasdaq. (See BioWorld Insight, Aug. 22, 2016.)

Biogen Inc.'s shares (NASDAQ:BIIB) closed up 5 percent in August.

Leading the decliners were Jazz Pharmaceuticals plc (NASDAQ:JAZZ) and Bristol-Myers Squibb & Co. (NYSE:BMY), whose shares fell 18 percent and 25 percent, respectively.

Jazz seems to have got caught up in biotech's general weakness in August rather than falling on any negative news. In fact, it reported that it had licensed the global rights to several early stage blood cancer candidates from Pfenex Inc. in a deal that also included an option on an exclusive license for PF690, a biosimilar of Baxalta Inc.'s acute lymphoblastic leukemia (ALL) therapy, Oncaspar (pegaspargase), access to which could give Jazz wider reach in ALL. (See BioWorld Today, Aug. 1, 2016.)

Pfenex and Jazz will each be responsible for their own expenses during development of the hematology candidates, though Jazz will take on certain third-party costs and internal expenses at Pfenex in connection with the program. Jazz will also be responsible for all expenses relating to the commercialization and regulatory approval for the hematology candidates. Pfenex will continue to carry all costs of developing PF690 until Jazz chooses to exercise its rights.

Shares of Bristol-Myers Squibb Co. cratered after surprising the Street by reporting a phase III failure of its blockbuster Opdivo (nivolumab) in the CHECKMATE-026 study. The drug did not reach statistical significance on the endpoint progression-free survival (PFS). The study tested the drug as a monotherapy vs. platinum-based chemo in patients with first-line disease whose tumors express PD-L1 at greater than 5 percent.

Evercore ISI analyst Mark Schoenebaum called the CHECKMATE-026 outcome "a major surprise, possibly the biggest clinical surprise of my career."

DRUG DEVELOPERS UNDERWATER

The BioWorld Drug Developers Index still languishes down 20 percent for the year and its performance in August, down 1.5 percent, reflected how investors are staying away from the sector. (See BioWorld Drug Developers Index, below.)

However, there have been some bright spots including group member Clovis Oncology Inc. seeing its shares (NASDAQ:CLVS) rocket up 74 percent in August on news that the FDA had accepted the company's new drug application (NDA) for accelerated approval of rucaparib for the treatment of advanced ovarian cancer in patients with deleterious BRCA-mutated tumors inclusive of both germline and somatic BRCA mutations (as detected by an FDA-approved test), and who have been treated with two or more chemotherapies. The agency also granted priority review status to the application with a Prescription Drug User Fee Act (PDUFA) date of Feb. 23, 2017.

The efficacy of rucaparib was assessed in 106 patients from two multicenter, single-arm, open-label clinical trials in patients with advanced BRCA-mutant ovarian cancer who had progressed after two or more prior chemotherapies. Median age was 59 years and median number of prior chemotherapy regimens was three.

All 106 patients received the starting dose of rucaparib 600 mg twice daily. The major efficacy outcome measure of both trials was objective response rate (ORR) and duration of response (DOR) as assessed by the investigator according to response evaluation criteria in solid tumors (RECIST) version 1.1. All responses were confirmed.

The company also reported that its companion diagnostic partner, Foundation Medicine Inc., has submitted a premarket approval application with the FDA for its diagnostic assay designed to identify both germline and somatic BRCA mutations. The timing of the submission is expected to allow for regulatory approval of the companion diagnostic at substantially the same time that rucaparib could be approved.

Leading the decliners was Sangamo Biosciences Inc. whose shares (NASDAQ:SGMO) slipped 32 percent in the month, mainly on news of delays in multiple zinc finger nuclease (ZFN) gene-editing programs and concerns expressed by analysts on management execution capability.

The company has eight programs in therapeutic development in addition to ongoing clinical trials to evaluate its ZFN-mediated genome-editing approach for HIV/AIDS in T cells as well as hematopoietic stem and progenitor cells.

Analysts expressed some cautious optimism that the company was reprioritizing its product pipeline under the direction of a new CEO, Sandy McRae, and according to J.P. Morgan analyst Whitney Ijem there is "value in the company's gene editing/gene therapy platform, and is hopeful that the new management can execute on the pre-clinical to clinical transition."

MONEY FLOWS BUT SLOWER

The biopharmaceutical sector is on pace to raise $25 billion in 2016, which isn't a bad haul. However, after several bumper years, the amount is probably less than it would have hoped for. At the end of August a total of $16.8 billion had been raised by private and public biopharmaceutical companies compared to $41.5 billion generated at the same point last year.

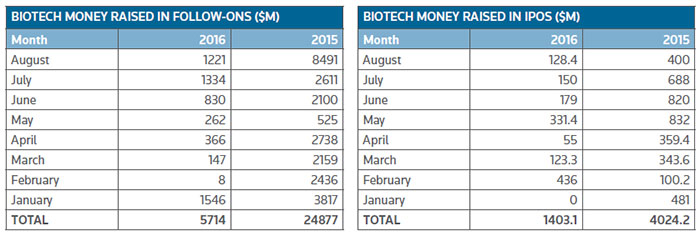

The lower valuation of biopharma stock prices has impacted follow-on financings according to data compiled by BioWorld. (See Biotech Money Raised In Follow-Ons, below.) The 2015 total of almost $25 billion was padded by an $8 billion note offering. Even removing this outlier transaction following-on financings for 2016 are tracking 66 percent lower than in 2015.

The amount raised from U.S. IPOs is also 65 percent lower than the comparable 2015 amount. Only 22 companies have made the transition to the public ranks compared to 40 at this point last year. (See IPO chart, below.)

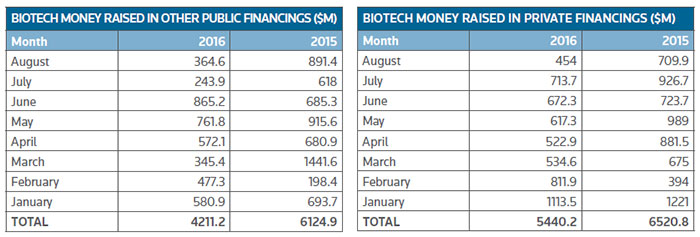

It is a similar story for other public financing deals and private financings. (See the charts, below.)

Private companies have, however, performed better than their public counterparts in terms of generating investments, with the total raised off by 16 percent so far but the deal flow has remained about the same at approximately 200.

LOOKING FORWARD

It is clear that the sector will be hard pressed to return the kind of numbers that investors have been used to for the past several years. Going forward the financial markets will continue to be wary of biotech equities until the "drug pricing" issues have more clarity and the presidential election is over.

Analysts are expecting biotech to recover its momentum in early 2017 and getting back to even at that time.

PrintOur news

-

14 March 2024

-

26 February 2024

-

NovaMedica team wishes you a Merry Christmas and a Happy New Year!

26 December 2023