The Evaluate Pharma Half-Year Review 2019 summaries the most significant trends across pharma, medtech and biotech

13 August 2019

Mega-deals mask a significant decline in M&A activity for pharma and medtech

Mega-deals mask a significant decline in M&A activity for pharma and medtech

The Vantage Half-Year Review 2019 summaries the most significant trends across pharma, medtech and biotech in the first half of 2019.

Bristol-Myers Squibb’s $74bn pending purchase Celgene and Abbvie’s $63bn acquisition of Allergan have taken the headlines, positioning 2019 to be a record year for pharma M&A spend, while Verily’s $1bn round of funding in Q1 was the largest ever seen in the medtech.

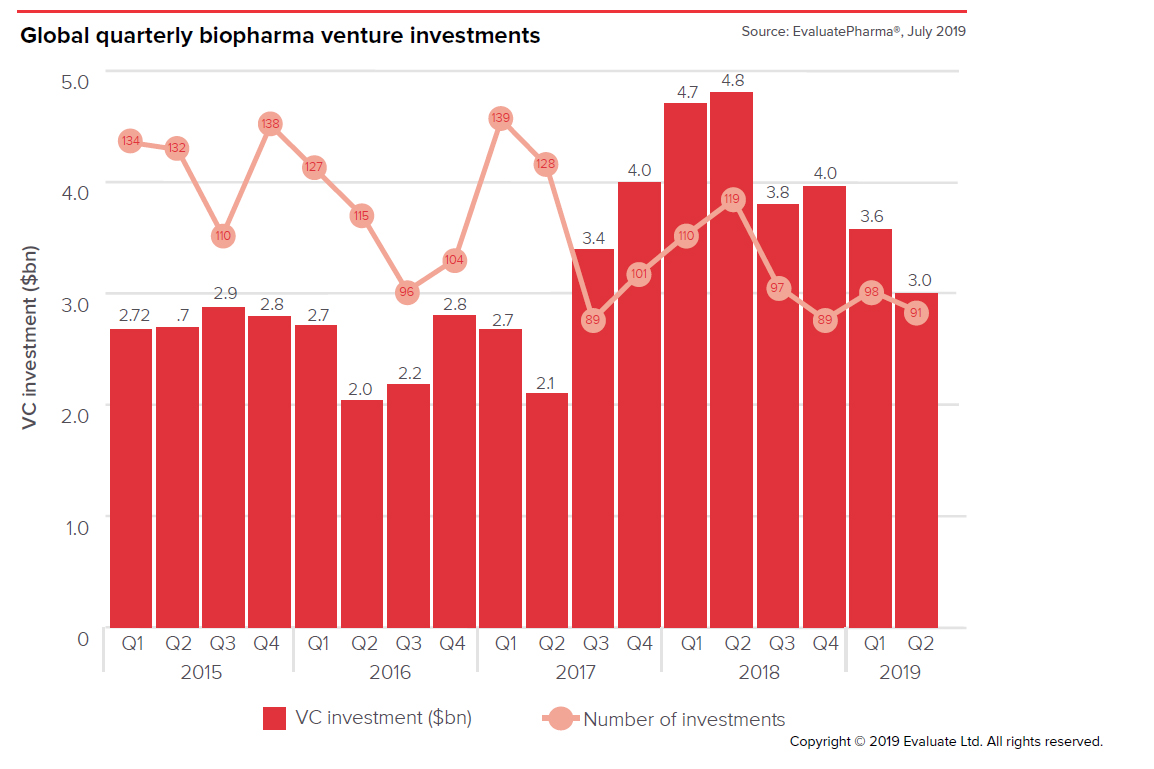

However, these colossal deals are masking a substantial slowdown in the total number of M&A deals in both pharma and medtech, and pharma doubled down on this trend with a similar drop in licensing activity. Investors remain cautious due to potential US drug reforms and elsewhere the biotech boom appears to be over, except for a couple of isolated bubbles.

Key highlights

-

2019 set to be a record year for pharma M&A spend, but mega-deals mask wider drop in deal numbers

-

Verily’s $1bn round of funding in Q1 was medtech’s largest ever, but the sector also experienced substantial declining deal numbers

-

Only 8 medtech companies went public during the first half of 2019, but collectively raised $1.3bn

-

Q2 biotech flotations raised $2bn, as investor enthusiasm attracts younger drug developers away from traditional M&A and partnerships

-

Uncertainty around potential US drug price reform continues to be a significant investor concern.

Our news

-

14 March 2024

-

26 February 2024

-

NovaMedica team wishes you a Merry Christmas and a Happy New Year!

26 December 2023

Media Center

-

CRISPR technologies fuelling haematological innovations

17 April 2024

-

17 April 2024

-

The share of Russian drugs can grow to 70% in seven years in the Russian market

16 April 2024

-

Russia may increase number of scholarships for Indian medical students

16 April 2024