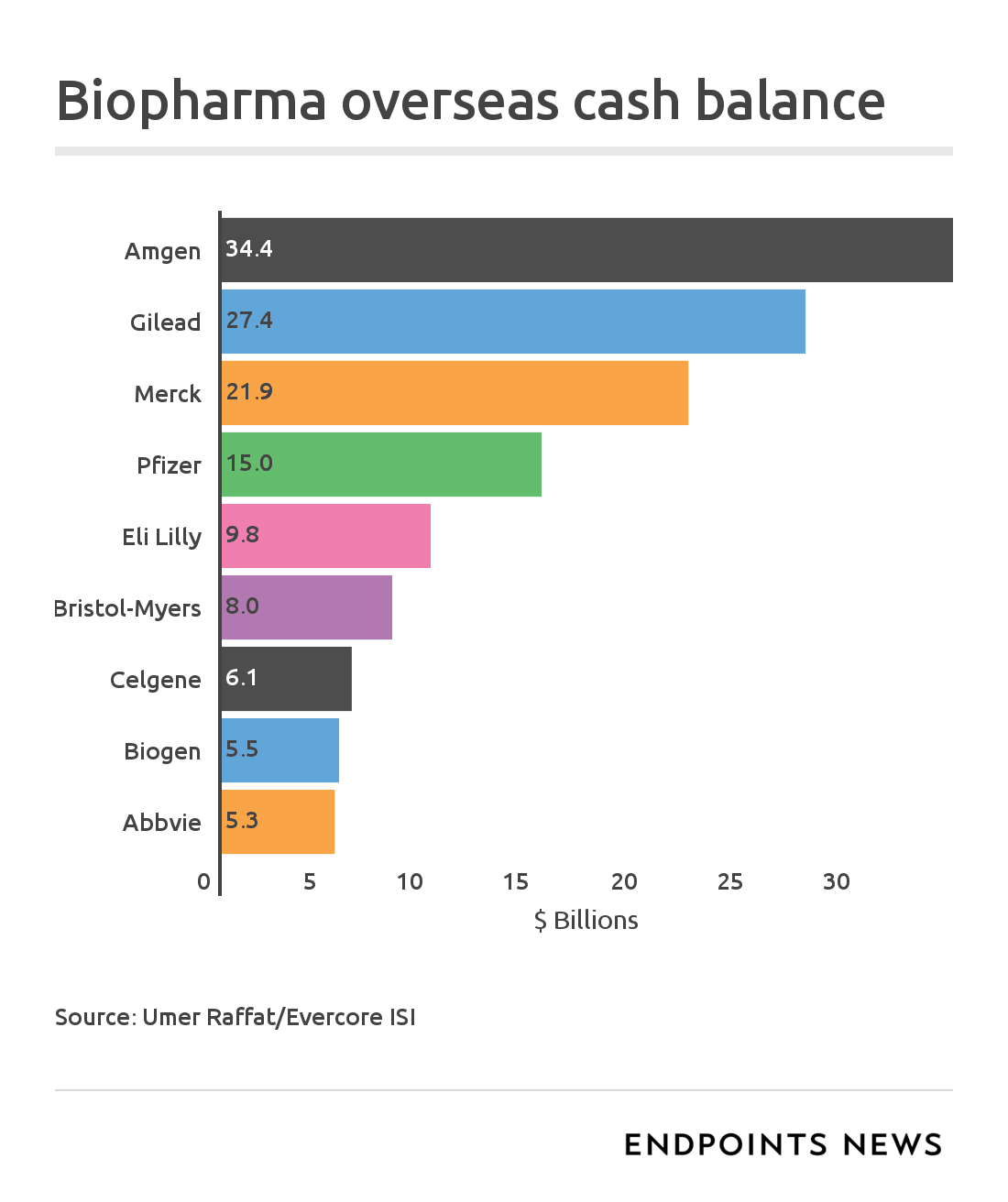

The top 9 overseas accounts in biopharma hold $133B in M&A firepower

27 April 2017

During Amgen’s Q1 discussion with analysts on Wednesday evening, CEO Bob Bradway repeated one of the key themes in the land of Big Biopharma. Biotech valuations are high, he noted, making it difficult to acquire the kind of drug assets he’d like to lay his hands on.

But. Tax reform could make M&A easier for Amgen.

And why is that? Says Bradway:

We’ve long advocated the need for corporate tax reform. If innovative U.S. companies are to remain competitive, we need a level tax playing field. We don’t have one now, but we’re hopeful this administration will deliver that in 2017. Obviously, we think such change would improve our flexibility for capital allocation.During Amgen’s Q1 discussion with analysts on Wednesday evening, CEO Bob Bradway repeated one of the key themes in the land of Big Biopharma. Biotech valuations are high, he noted, making it difficult to acquire the kind of drug assets he’d like to lay his hands on.

But. Tax reform could make M&A easier for Amgen.

And why is that? Says Bradway:

We’ve long advocated the need for corporate tax reform. If innovative U.S. companies are to remain competitive, we need a level tax playing field. We don’t have one now, but we’re hopeful this administration will deliver that in 2017. Obviously, we think such change would improve our flexibility for capital allocation.

Amgen has been sheltering a cache of about $35 billion in ex-US accounts, according to some numbers that EvercoreISI’s Umer Raffat put together as he began assessing the impact tax reform could have on the top players in overseas holdings.

Raffat’s quickly assembled top 10 — based on filings and conversations with execs, rearranged by order of ex-US holdings — add up to roughly $133 billion. That’s enough to fuel quite a few acquisitions.

A year ago, by the way, a number of stories in the financial press cited Pfizer for holding $80 billion in overseas accounts. But this gives you an idea of some of the cash that would be available to the big US players if tax reform allowed for quick repatriation.

Sweeping tax reform, though, may be even harder to do than healthcare reform. But you’ll note that there are several companies on this list that have indicated that they are hunting deals, particularly Amgen, Gilead, Pfizer and Biogen. At Celgene, the deal pace has been constant for years now.

So far, 2017 has been something of a disappointment in the M&A world. Maybe some of these companies are just holding fire, though, to see how the landscape changes in the next few weeks.

Amgen has been sheltering a cache of about $35 billion in ex-US accounts, according to some numbers that EvercoreISI’s Umer Raffat put together as he began assessing the impact tax reform could have on the top players in overseas holdings.

Raffat’s quickly assembled top 10 — based on filings and conversations with execs, rearranged by order of ex-US holdings — add up to roughly $133 billion. That’s enough to fuel quite a few acquisitions.

A year ago, by the way, a number of stories in the financial press cited Pfizer for holding $80 billion in overseas accounts. But this gives you an idea of some of the cash that would be available to the big US players if tax reform allowed for quick repatriation.

Sweeping tax reform, though, may be even harder to do than healthcare reform. But you’ll note that there are several companies on this list that have indicated that they are hunting deals, particularly Amgen, Gilead, Pfizer and Biogen. At Celgene, the deal pace has been constant for years now.

So far, 2017 has been something of a disappointment in the M&A world. Maybe some of these companies are just holding fire, though, to see how the landscape changes in the next few weeks.

PrintOur news

-

14 March 2024

-

26 February 2024

-

NovaMedica team wishes you a Merry Christmas and a Happy New Year!

26 December 2023

Media Center

-

Achieving FAIR bacterial identification

18 April 2024

-

Unique testing regimen could prevent nuclease contamination

18 April 2024

-

CRISPR technologies fuelling haematological innovations

17 April 2024

-

17 April 2024